The Gas Reliability Infrastructure Program, or GRIP, allows monopoly gas utilities to hike rates even if the company’s overall expenditures are on the decline, or even if its revenues are increasing. Under the rules of GRIP, a utility need only claim extra investment associated with one part of its business — capital costs associated with infrastructure — and then it can obtain a rate hike.

The Gas Reliability Infrastructure Program, or GRIP, allows monopoly gas utilities to hike rates even if the company’s overall expenditures are on the decline, or even if its revenues are increasing. Under the rules of GRIP, a utility need only claim extra investment associated with one part of its business — capital costs associated with infrastructure — and then it can obtain a rate hike.

Railroad Commissioners grant these hikes as a ministerial act without consideration of the utility’s overall revenues, without consideration of offsetting savings in other areas of the utility’s business or even whether the infrastructure investments are prudent. Unlike a more traditional rate case, there is no avenue in a GRIP case to prevent a utility from charging ratepayers for imprudent utility expenditures.

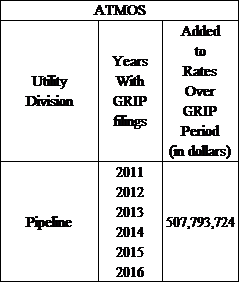

GRIP, which was created in 2003 by the Texas Legislature, allows gas utilities to h ike rates in this fashion once a year, for up to six years. At the end of that period, the utility is required to submit to a comprehensive rate case. What does this mean for ratepayers? Consider that Atmos Pipeline has employed the GRIP statute to increase rates 6 times since 2011, increasing rates cumulatively by more than $507 million.

ike rates in this fashion once a year, for up to six years. At the end of that period, the utility is required to submit to a comprehensive rate case. What does this mean for ratepayers? Consider that Atmos Pipeline has employed the GRIP statute to increase rates 6 times since 2011, increasing rates cumulatively by more than $507 million.

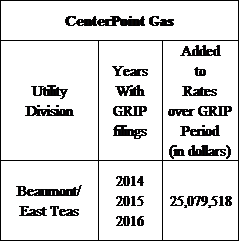

A similar pattern can be found with other Texas gas utilities. For instance, GRIP hikes have contributed to nearly $25 million in added costs since 2011 for the Beaumont/East Texas customers of CenterPoint Gas.

On average, Texans found themselves paying more for gas utility service in 2015 than they did in 2004, despite a precipitous drop in natural gas commodity costs. Frequent rate hikes associated with GRIP have contributed to these higher-than-necessary bills.