The regulatory decision means that ratepayers will end up paying over many years for fuel they consumed during a single month.

________________________________________________

The Texas Railroad Commission has authorized the use of $3.4 billion in long-term debt to pay for natural gas consumed during Winter Storm Uri.

The regulatory decision means that ratepayers will end up paying over many years — potentially up to 30 — for fuel consumed during a single month. The Railroad Commission approved the debt financing arrangement on November 10.

Atmos, CenterPoint, Texas Gas Service and eight other gas utilities applied for financial recovery under the debt financing deal, which has been promoted as a method to help gas utility customers avoid rate shock. Under ordinary circumstances, the cost of natural gas consumed by utility customers would have flowed directly into monthly bills. During Winter Storm Uri, however, gas prices spiked to intolerable levels and so gas utilities instead set aside those costs as “regulatory assets” to deal with later. The bond financing approved Nov. 10 will allow the utilities to receive reimbursements for those expenses.

Atmos, CenterPoint, Texas Gas Service and eight other gas utilities applied for financial recovery under the debt financing deal, which has been promoted as a method to help gas utility customers avoid rate shock. Under ordinary circumstances, the cost of natural gas consumed by utility customers would have flowed directly into monthly bills. During Winter Storm Uri, however, gas prices spiked to intolerable levels and so gas utilities instead set aside those costs as “regulatory assets” to deal with later. The bond financing approved Nov. 10 will allow the utilities to receive reimbursements for those expenses.

The downside for ratepayers is that they will have to pay off the bonds over many years — and with interest. The size of the resulting bill charges remains unclear. A separate state agency known as the Texas Public Finance Authority will issue the bonds.

“The Railroad Commission has 90 days to issue a financing order which instructs the Texas Public Finance Authority to issue bonds,” an official with Texas Gas Service, a gas utility, said in an email distributed to the media. “After that, the Texas Public Finance Authority has 180 days to issue the bonds. As this process unfolds, the length of time for recovery and the rate charged to customers will be determined.”

“The Railroad Commission has 90 days to issue a financing order which instructs the Texas Public Finance Authority to issue bonds,” an official with Texas Gas Service, a gas utility, said in an email distributed to the media. “After that, the Texas Public Finance Authority has 180 days to issue the bonds. As this process unfolds, the length of time for recovery and the rate charged to customers will be determined.”

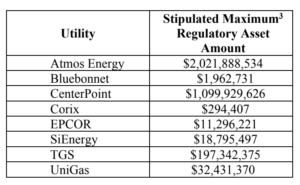

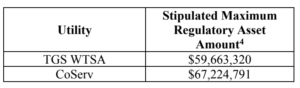

UTILITIES PARTICIPATING IN PROGRAM

Under the agency decision, Atmos Energy can receive reimbursements for approximately $2 billion in fuel costs, CenterPoint can receive approximately $1.1 billion and TGS can receive $197.3 million. Other utilities to receive recovery include Bluebonnet, Corix, EPCOR, SiEnergy, UniGas, TGS West Texas Service Area and CoServ.

Under a settlement with Atmos Cities Steering Committee and others, Atmos agreed to reduce its regulatory asset by more than $9 million. Similarly, CenterPoint agreed to reduce its regulatory asset by $39.7 million.

The bond financing process (it’s known as securitization) received earlier authorization by the Texas Legislature, under House Bill 1520. Utilities promoted the bond financing technique to lawmakers as a way to spread out the pain from the massive price spikes, with one utility explaining in testimony that it paid 22 times more than usual for gas during the weather emergency. Others reported that the commodity cost of natural gas spiked to levels 150 times greater than typical. “It would be like you’re going to fill up your gas tank during the storm … and instead of paying $50-ish to fill up your tank, the register there reads … $6,000 to $7,000,” one former utility official said in a media interview.

By law, gas distribution utilities such as Atmos, CenterPoint and TGS cannot profit from the sale of the gas commodity, but instead pass those costs directly to end users without markups. However, some gas suppliers made massive profits from the price surge, according to reports.