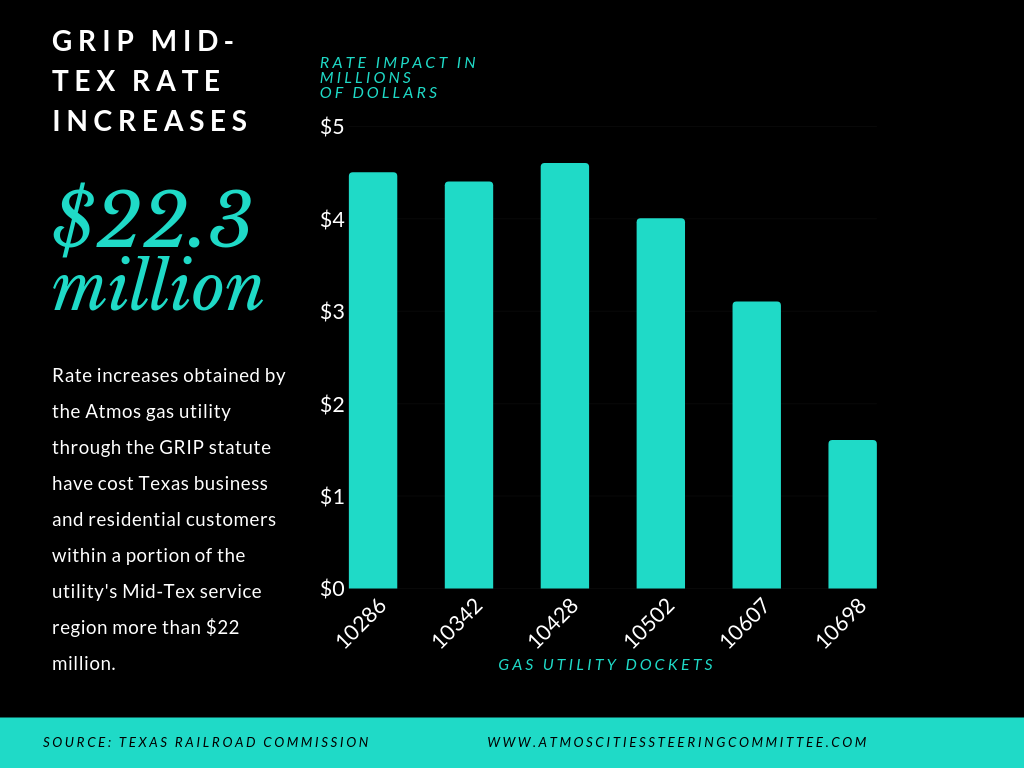

The ACSC reviewed a series of GRIP rate increases in a portion of the Atmos service area.

By R.A. Dyer

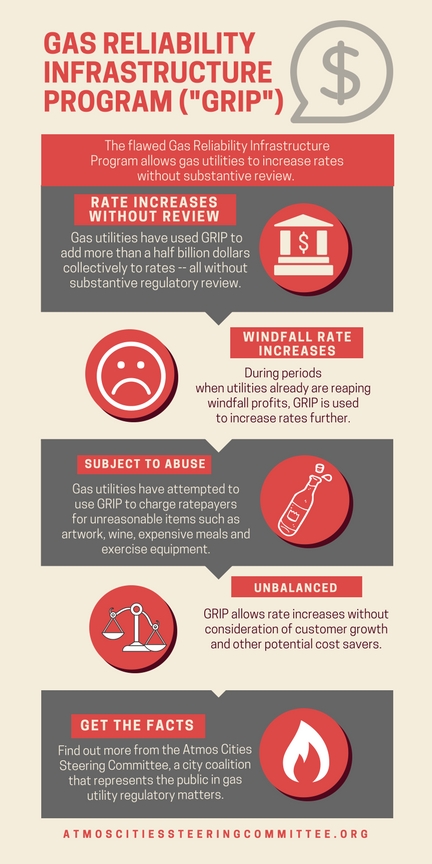

The Gas Reliability Infrastructure Program, or GRIP, allows monopoly gas utilities to increase rates even if the company’s overall expenditures are declining, even if its revenues are increasing or even it the company is earning windfall profits. Under GRIP rules, a utility need only claim it made extra capital investments and then it obtains a rate increase. Regulators grant GRIP increases as a ministerial act without consideration of offsetting savings in other areas of the utility’s business. And unlike more traditional rate cases, nothing in GRIP rules prevents a utility from charging ratepayers for imprudently incurred capital expenditures.

Find out more about the Gas Reliability Infrastructure Program in this report from the Atmos Cities Steering Committee.

We reviewed a series of GRIP cases between 2013 and 2018 affecting about a half million residential customers living in a portion of the Atmos Mid-Tex service region. These 500,000 customers live outside the cities of Dallas and Fort Worth and outside other nearby incorporated areas. During that six-year period, the Texas Railroad Commission approved six GRIP increases, in succession, and each added between $1.20 and $2.02 to monthly residential bills. In 2018, Texans impacted by these increases paid approximately $123 more per year than they would have paid otherwise. All told, the Atmos utility collected more than $22.3 million in additional revenue from residential and business customers because of these GRIP increases.

See the chart, above. We drew the underlying data used in this analysis from Gas Utility Dockets 10698, 10607, 10502, 10428, 10342 and 10286. You can find all the final orders in these dockets on the Texas Railroad Commission website, here. Note also that Atmos Energy likewise received millions of dollars in additional revenue through separate GRIP filings associated with its pipeline business. That separate GRIP revenue is not included in this analysis, although it also added indirectly to home bills.

Prior to the 2003 implementation of the GRIP statute, the Texas Railroad Commission typically considered utility expenditures, revenues, tax savings, the prudence of investments and other factors when setting gas rates. Under the 2003 law, however, gas utilities can avail themselves of pro forma GRIP increases once a year, for up to six years, with no substantial review. At the end of that period, the utility must submit to a comprehensive rate case.

Utilities defend the GRIP rules, claiming that such quick rate increases allow them to manage their infrastructure investments in a more efficient manner. More specifically, the utilities claim the GRIP program reduces “regulatory lag,” which is that period of time between when a utility makes infrastructure investments and when it would receive reimbursement for the investments through rates.

However, utilities already have a duty and incentive to make prudent infrastructure investments — no further regulatory incentive should be required. Leading economists also note that some amount of regulatory lag encourages utility efficiency.

Gas utilities also claim that consumers who pay too much under GRIP will recover those over payments later, when the utility participates in a more traditional rate review. The problem here is that gas utilities will go for years without such review. In the meantime, the GRIP statute sticks consumers with inflated rates while utilities rake in millions in what often are excessive profits. Inherent inefficiencies with GRIP (such as those associated with regulatory lag) also make it unlikely that consumers ever will recoup their losses. Determining whether utilities prudently incurred expenses during the long gap between full-blown rate cases also can be extremely difficult.

You can find out more about GRIP in a report from the Atmos Cities Steering Committee, found here.