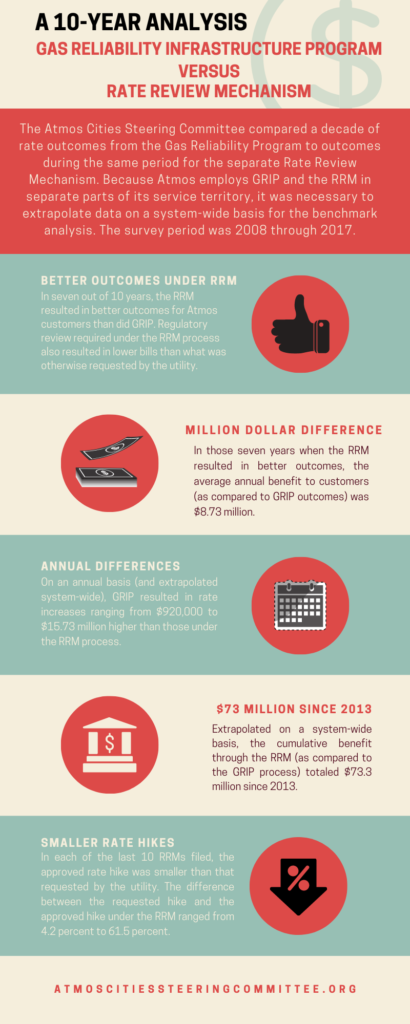

In seven out of 10 years, the RRM resulted in better outcomes for Atmos customers than did GRIP.

In seven out of 10 years, the RRM resulted in better outcomes for Atmos customers than did GRIP.

Chances are, if you live in Texas you pay money each month to a monopoly energy utility. This goes for nearly anyone who receives home gas service or anyone who receives electricity through a transmission or distribution line.

This also means that you depend on Texas utility regulators for fair rates. Without free-market competition, utilities otherwise could charge whatever they wanted. Monopoly utilities could gouge customers at will.

In Texas, the Railroad Commission oversees gas utilities and the Public Utility Commission oversees electric utilities. But, whether before the Railroad Commission or the PUC, utilities in most cases are required to submit to some level of advanced substantive review if they want to increase rates.

There is, however, one notable exception. The Gas Reliability Infrastructure Program (or “GRIP”), authorized by the Texas Legislature in 2003, allows gas utilities to increase rates on an annual basis to pay for certain investments. Utilities can hike rates once per year for six years before submitting to a more thorough rate case. However, GRIP allows utilities to implement these interim rate increases without any substantive review. This means that gas utilities can hike rates without consideration of offsetting savings, without consideration of revenue levels — without even consideration of the prudence of their underlying investments.

Independent analysts have employed various benchmarks to judge the impact of GRIP on consumers. Invariably, these analyses have found the controversial program has led to needlessly high rates.

Although not reviewed here, a summary of some of those separate analyses can be found here, here and here. Instead, this analysis benchmarks GRIP rates against those promulgated through a separate rate-setting mechanism known as the Rate Review Mechanism.

THE BACKGROUND

The Texas Legislature authorized GRIP in 2003, and updated GRIP rules during the following legislative session in 2005. Because of concerns with GRIP, in 2007 the Atmos Cities Steering Committee negotiated with Atmos Energy to create the Rate Review Mechanism (also known as the “RRM”) as an alternative to GRIP.

The RRM applies only to Atmos rates charged within cities that comprise the Atmos Cities Steering Committee. Like GRIP, the RRM permits utilities to hike rates on an annual basis. However unlike GRIP, RRM rules require utilities to submit their rate hike requests to contemporaneous regulatory scrutiny. RRM rules set forth various deadlines for expedited reviews, and allow for an examination of various mitigating factors with a potential to lower utility rate requests.

Atmos, which serves about 1.6 million customers in north, central and west Texas, employs both GRIP and the RRM. Atmos typically employs GRIP in those parts of its service territory that lie outside the territorial boundaries of cities. The RRM it employs in areas falling within the boundaries of ACSC cities.

The Analysis

For purposes of this benchmarking analysis, the ACSC compared a decade’s worth of GRIP data to a decade’s worth of RRM data. The analysis period was 2008 through 2017.

The analysis accounts for GRIP outcomes, RRM rate requests and final RRM rate outcomes. Because Atmos employs GRIP and the RRM in separate parts of its service territory, it was necessary to extrapolate data on a system-wide basis to effect apples-to-apples comparisons for parts of this analysis.

In seven out of 10 years, the RRM resulted in better outcomes for Atmos customers than did GRIP, according to the analysis. Regulatory review required under the RRM process also resulted in lower bills than what the utility otherwise requested.

Other findings include:

- In seven out of 10 years — 2009, 2011, 2012, 2013, 2014, 2015 and 2017 — Atmos customers fared better under the RRM covenant than under the GRIP process. That is, though Atmos received authorization for rate hikes through both processes, the RRM during those seven years resulted in smaller per-customer hikes than did the GRIP process.

- In those seven years, the average annual benefit under the RRM (as compared to GRIP outcomes) was $8.73 million.

- On an annual basis (and extrapolated system-wide), GRIP resulted in rate increases ranging from $920,000 to $15.73 million higher than those under the RRM process.

- Extrapolated on a system-wide basis, the cumulative benefit through the RRM process (as compared to rate outcomes under the GRIP process) totaled $73.3 million since 2013.

- Extrapolated on a cumulative, system-wide basis, the cost of GRIP was 16.9 percent higher than RRM since 2013.

- In each of the last 10 RRMs filed, the approved rate hike was smaller than that requested by Atmos. The difference between the requested hike and the approved hike under the RRM ranged from 4.2 percent to 61.5 percent. On a per residential customer basis, the avoided cost savings ranged from about $1 per year to $23.

Trackbacks/Pingbacks